The Secret to Making the Perfect Real Estate Investment in Any City

You have decided that you are ready to take advantage of current opportunities in the real estate market. You already have the money and you have decided to fund a real estate project in a nice neighborhood which you have assessed to have huge potential. However, you are unsure whether the project that you intend to pursue in that location will give you the most favorable returns on your investment. Wherever you are in the country, you can count on a metric to help you identify the best real estate investment opportunity in a particular place. It is called the price-to-rent ratio. Never heard of it before? We will help you know and understand what it is and how it can help you in making the best investment in a given location.

What is the Price-to-Rent Ratio?

The price-to-rent ratio is a metric commonly used by people to inform them of the right decision whether to buy or rent in a given neighborhood. It combines two different variables namely the median home value and the average annual rent; the resulting quotient is PTR which allows prospective buyers and renters to make an evaluation of the most affordable option for living arrangements. However, the ratio can be used for other purposes and transformed to inform investors of the best places to flip a home to sell or purchase properties for rental.

How to Compute the Price-to-Rent Ratio?

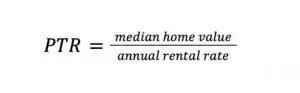

Calculating the price-to-rent ratio does not involve complicated math. After all, you only need two variables: the median home value in a given location and the average rent of a similar home in the same area within a year. Once you have those two inputs, they can be simply substituted into the equation:

That is how simple calculating price-to-rent ratio is. Dividing the median home value by the annual rental rate of a comparable home will yield you the price-to-rent ratio. While you may be keen on doing a simple Google search for the price-to-rent ratio in an area you are interested in putting your real estate investment in, the volatility in home values and rent might provide you with an inaccurate number. Thus, it is better to do the calculation yourself to obtain a more accurate price-to-rent ratio value. But where are you going to find the data for median home value and annual rental rate? Both variables are actually readily available on the internet. Websites like Zillow and RedFin are equipped with searchable databases for finding home values in a particular area. Information on rental rates, on the other hand, can be obtained from ApartmentList with their comprehensive rental database.

How Can Price-to-Rent Ratio Help You?

Your price to ratio calculation will most certainly churn out a number which can be interpreted using the following ways:

15 & Under (Low): A price-to-rent ratio of 15 or less suggests it is more affordable to buy than rent.

16-20 (Moderate): A price-to-rent ratio between 16 and 20 suggests it may be better to rent than buy.

21 & Higher (High): A price-to-rent ratio of 21 or more suggests it’s better to rent than buy.

Once you have classified where the price-to-rent ratio you have computed is clustered in, you would have an initial idea as an investor what would be the ideal real estate investment for the location. Investors can either look at flipping a property to either sell or rent out whichever can bring a stronger return on investment. A high price to rent ratio may indicate a high demand for rental property for real estate investors. On the other hand, markets where the price to rent ratio is low may indicate that there will be a lower demand for rental property, because home prices are lower relative to the annual rent price. Thus, it may be wiser to invest in buying properties to flip and sell in the latter.

Below is the price-to-rent ratio in the 10 most populous US Cities:

|

City |

Median Home Value |

Annual Rental Rate |

Price-to-rent Ratio |

|

New York |

$793,250 |

$35,978 | 22.05 |

|

Los Angeles |

$924,917 |

$29,573 | 31.28 |

|

Chicago |

$341,833 | $19,520 | 17.51 |

|

Houston |

$298,583 |

$15,683 |

19.04 |

|

Phoenix |

$395,750 | $16,051 |

24.66 |

|

Philadelphia |

$261,083 | $18,611 |

14.03 |

|

San Antonio |

$262,500 | $13,796 |

19.03 |

|

San Diego |

$778,500 | $28,372 |

27.44 |

|

Dallas |

$388,417 |

$19,042 |

20.40 |

|

San Jose |

$1,261,667 | $29,929 |

42.16 |

What does a high Price-To-Rent Ratio mean?

Cities with high price-to-rent ratio do not necessarily imply that they offer the best opportunities for investment. Most of the cities have moderate price-to-rent ratios. Cities in this category can be a strong alternative to high ratio markets. These properties can provide many of the same benefits, such as consistent demand, while also offering lower overall purchase prices. Investors who are unable to enter the competitive markets associated with high price-to-rent ratios may find it easier to secure an investment in more moderate areas. The key for making investment decisions in moderate areas is to breakdown the price-to-rent ratio for each zip code within. By comparing the price to rent ratio in the specific city to the price to rent ratios in each zip code within it, an investor can close in on areas that might be good for owning rental property or otherwise. If a zip code has a PTR lower than the city, the area could be more attractive for home ownership versus renting.

Now you have a tool that provides you an easy and quick way to make your investment decision based on just two data points: the median home price to the median annual rent. Using PTR, real estate investors can select areas that may be good for whatever property investments you plan to pursue.

Investing In Houston

If you want to start your investment in Houston, yet you are short on cash to start on your project GL&L Holdings will be here to help you! At GL&L Holdings, we push ourselves to provide what we think is the best hard money lending in Houston. Feel free to look around the area and let us match their terms and conditions. We have over a decade of experience providing loans for successful rehabs, refinances, purchases, and new construction projects. We’re local and family-owned, and we know what it takes to win at Houston real estate. If you are ready to apply for a hard money loan, please give us a call at (832) 770-9415 or use our online contact form. We look forward to hearing from you.