Why can’t you get a loan?

You have a great real estate deal, but you can’t get a loan from your traditional lenders. Your bank has declined your loan application. There are many reasons why a loan application fails. To name a few, these are unverifiable income sources, collateral, residency qualifications, high debt to income ratios, and low credit scores. Two of the most common reasons banks do not approve your loan application are your Debt-to-Income Ratio and Low Credit Scores. Traditional lenders are very conservative when they give the green light to loan applications, thus the reason for many borrowers finding ways to obtain hard money loans. Loans for small businesses may be hard to find, particularly if you have an imperfect credit history. But, there are hard money lenders who can work with you even if you have a 500 credit score.

What is Debt To Income Ratio and Low Credit Score

To understand these better, you need to get an overview of what a Debt-to-Income Ratio and a Credit Score is and how they influence the outcome of your loan application.

Debt to Income Ratio

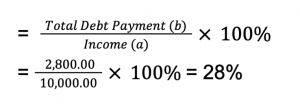

The debt-to-income ratio shows how much your debt payments are as a portion of your income. The acceptable ratio is between 30% to 40%, depending on the preference of a lender. So to qualify, your debt payments must not exceed 30% or 40% of your income. See the computation below so you can at least have an idea of how to calculate your Debt-To-Income Ratio. The formula below simplifies how lenders compute debt to income ratio. However, banks and lenders vary in their respective approaches.

| Income (a) |

10,000.00 |

|

| Debt Payment 1 |

300.00 |

|

| Debt Payment 2 |

1,500.00 |

|

| Proposed Debt payment 3 |

1,000.00 |

|

| Total Debt Payment (b) |

2,800.00 |

In the above illustration, your total debt payment is 2,800.00, and your income in the same period is 10,000.00. Debt payments can include auto loans, mortgages, credit cards, student loans, personal loan payments, and other monthly loan obligations that you may have.

Thus, Debt To Income Ratio:

A 28% Debt-to-Income Ratio means that your income and debt servicing ratio is within the parameters of your lender. On the contrary, if your proposed Debt Payments total 4,300.00, your debt to income ratio will be 43%, which is more than what is allowed by your lender. Thus, most likely, you will have a disapproved loan application in your hand.

The debt to Income ratio protects borrowers from over-borrowing. The rule of thumb in borrowing is that you should always have at least 60% left from your income to afford the necessities for a comfortable life. The 60% should cover your family’s basic expenses for shelter, education, medical, food, and clothing. Thus you are assured of having funds for the usual living expenses within a period.

Credit Score

What is a credit score, and how does it affect your financial plans? For the US Consumer Financial Protection Bureau, a credit score predicts how likely you will pay back a loan on time. Investopedia defines this further as “a numerical representation of financial health, telling lenders at a glance how responsible you are with credit and debt. Generally speaking, a higher credit score suggests that you borrow and pay back what you owe on time. A lower credit score, on the other hand, may hint that you struggle with managing debt obligations.”

What this means is that credit bureaus or agencies assign a number to your capabilities based on financial factors, some of which are as follows:

- Current Loans.

- Payment History on all loans and bills, previous and current.

- How much of your credit is used or available.

- The number and type of loans you have.

- Any loan applications or inquiries on your credit score.

One of the more popular credit scoring models is the FICO Score from First Isaac Corporation. They devised the model from a call from the government to standardize credit scoring. A FICO credit score ranges from 300 to 850. And in the middle are the other classifications your score may fall into, depending on the factors above. A higher score means that your loan application has more chances of approval than those with lower scores. According to the FICO model, here is how your credit score is seen and classified by banks and lenders:

- 800 and above: Exceptional

- 740 to 799: Very good

- 670 to 739: Good

- 580 to 669: Fair

- 300 to 579: Poor

For example, a credit score of 700 will give you a “good” rating, but you need to prepare more documents to prove and improve your creditworthiness.

With a 500 credit Score, What are my options?

Having a credit score with a poor rating will lower your chances of being approved by traditional lenders. But, no matter how slim your loan chances are, you have many other options to secure a loan. One of these options may take time and patience, and you have to be diligent in working towards a positive outcome. Here are two options you can consider to secure a loan.

Improve your Credit Score

Improving your credit score will also improve the chances of your loan application getting approved. You will need to make adjustments to your budget, and you will need to be dedicated to the task as the improvement will not come to you overnight. Adjustments to your budget mean that you will have to pay off all or some of your debts over time. Another adjustment is that you may have to sell off some of your assets to help pay off your debts. Your payments need to be on time, and all your debts must be on the current status. Also, refrain from applying for loans that check your credit score and history. Credit inquiries have an impact on your score. Improving your credit score is not easy because it needs dedication and discipline to see it through.

Hard Money Lenders

Hard money lenders are one of the best funding sources where you can secure a loan for real estate deals. Hard Money Lenders do not work as traditional banks do. They go beyond the usual requirements of an excellent credit score and a better than acceptable debt to income ratio. Many investors who seek loans for small businesses go to Hard Money Lenders not only when they find it difficult to get approval from their banks but because of the established business relationships. Hard Money Lenders put weight on other factors when evaluating your loan application. So even if you have a credit score of 500, hard money lenders can make it work, almost always, for you.

Local Hard Money Lenders know the local market like the palm of their hands. Look for hard money lenders who know the local real estate market well. They may even give you free consultation or advice on your investment plan.

Whether you are new to real estate investing or new to hard money loans, there are friendly hard money lenders for beginners. Lenders are happy to help you and guide you through the real estate investment process.

Go for the Alternative Options

Even with low credit scores and high debt-to-income ratios, you have other options in pushing through with your real estate investment. You can improve your credit score over time or try the services of Hard Money Lenders. Hard Money Lenders are more than willing to help you out because they build their business with long-term client relationships. If investing in Houston or other states, check out GL&L Holdings.

GL&L Holdings is a hard money lender willing to help out on your real estate deals. Call us now at (832) 770-9415 or send an email at info@gllholdings.com.