Like all other loans, a Hard Money Lender binds a loan contract with terms that define the loan amount, interest rate, period of payment, and other conditions. The loan terms show how much you will be paying and for how long. They are also interconnected, and any change in one affects the others. For instance, a lower term increases monthly amortization, and so can a higher interest rate. A lower interest rate can decrease monthly amortization, and so can a higher equity. In this article, we will help you decode Hard Money Loan terms and learn how they relate to each other.

We will also help you understand Hard Money Loan terms better so you can perform a more in-depth analysis of your loan application. With this knowledge, you can discuss your loan terms with your lender for a more comfortable repayment scheme.

Hard Money Loan Terms Defined

To demonstrate the dynamic relationships between Hard Money Loan terms, we will illustrate this with an example. But before that, let us first define each one of them.

1. After Repair Value

The ARV is the After Repair Value of your property. Appraisers derive this value from various sources. They consider property location, the home market in the area, your plans, and the cost of property improvements to compute the ARV. Third-party appraisal agencies accredited by your lender usually prepare the appraisal report of a collateral property.

2. Loan-To-Value Ratio

Also popularly known as the LTV ratio, this is the percentage a Hard Money Lender is willing to give as Loan Amount. It is based on your property’s ARV or After Repair Value. Hard Money Lenders usually allow LTV ratios of not less than 75% of the ARV. The low LTV ratio serves to protect their interests in the transaction.

3. Loan Amount

The ARV and LTV ratio defines how much an investor can borrow against the property. To compute for the maximum amount allowed on the property, you multiply your ARV with your LTV Ratio. To illustrate, if your property’s ARV is $500,000.00 and LTV is 75%, you will get a maximum Loan Amount of $350,000.00.

4. Owner’s Equity

Also referred to as simply Equity, it is your share in the property you are present as collateral. Proactively, it is what you have to shell out in cash to fill the difference between the value of the property and the loan amount. Equity in traditional mortgages is also known as the downpayment for the property. Hard Money Lenders require high equities to compel borrowers to be more involved in the deal.

5. Interest Rate

The interest rate is the cost of the money you borrow, which also defines how much a lender charges as income from the funds lent to you. Lenders usually quote Interest Rates on a monthly or annual basis. Sometimes, though, lenders quote rates for the whole loan period. Interest rates for Hard Money Loans range from 8% to 15% per year. Your interest rate may depend on how potentially profitable your real estate project proposal is.

6. Loan Term

Not to be confused with the terms and conditions of a loan, the loan term is your payment period. Hard Money Loans are relatively short-term loans with terms ranging from 3 months to a maximum of 36 months. Real Estate investors find short-term loans advantageous because they do not have to wait long for the loan to mature. Real estate investors designed their business model to pay off loans within a short term.

7. Origination Points

Origination Points are the fees your lender charges to process the loan application. These charges go to operational costs that include underwriting, verifications, and loan processing, to name a few. Essentially, 1 point is equal to 1% of the loan amount. Thus, a fee of 3 points is equivalent to $12,000 on a $400,000.00 loan.

Understanding Hard Money Loan Terms

Here are sample loan scenarios to help you decode, visualize, and understand Hard Money Loan terms more. For these illustrations, we have made assumptions. The numbers for all graphs are the same unless otherwise indicated.

Table of Loan Numbers

| ARV (After Repair Value) | $500,000.00 |

| LTV (Loan-to-Value) ratio | 75% |

| Loan Amount ($500,000*75%) | $375,000.00 |

|

Equity ($500,000.00 – $375,000.00) |

$125,000.00 |

| Loan Interest Rate per Year | 10% |

| Loan Term | 12 months |

| Closing Fees (Points) | 3 points |

Mode of Repayment: Monthly Interest payments, full principal payment upon loan maturity. Note that the Loan Amount is reflected on the right side of the graphs.

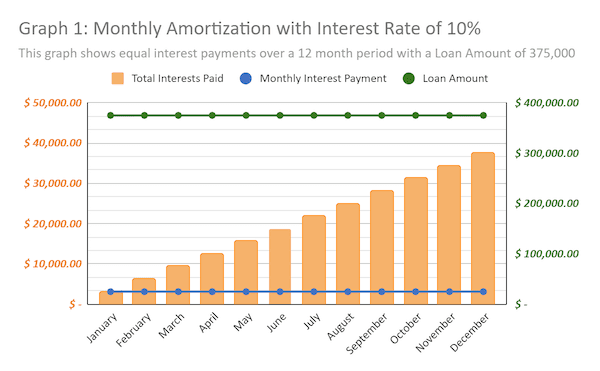

Monthly Amortization with Interest Rate of 10%

Graph 1 represents the first scenario with the initial figures. You can see with the green line that the Principal Amount borrowed remains the same throughout the loan period. In this case, you only make equal monthly interest payments, represented by the blue line. The orange columns represent cumulative interest payments. Note that the columns go higher as the loan progresses. For instance, by July, you would have made $21,875.00 in interest payments, and by the end of the year, your interest payments would have reached $37,500.00. The faster you repay your loan, the less interest you will pay.

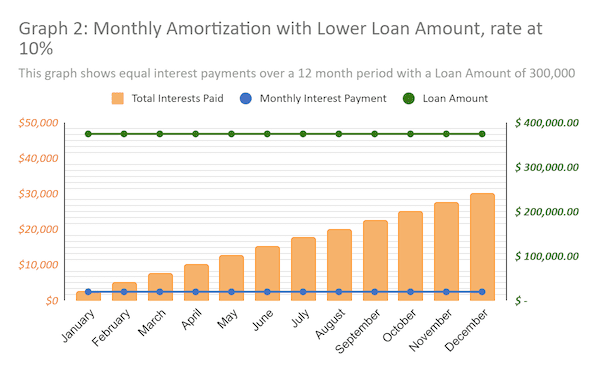

Monthly Amortization with Lower Loan Amount, Interest Rate at 10%

For Graph 2, the same interest rate applies with the same 12-month term. However, Equity has now increased to $200,000.00, thus, the Loan Amount is now only $300,000.00. Note the effect of a higher Equity on the monthly interest payments, which are now lower at only $2,500.00 per month. Interest payments now only total $30,000.00 for the whole term. Relative to Graph 1, you can save $7,500.00 in interest payments alone. With a lower loan amount, origination fees will only cost you $9,000.00 from $10,500 in the first graph.

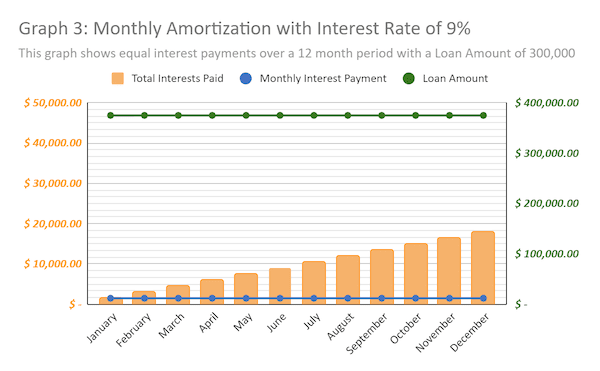

Monthly Amortization with Interest Rate of 9%

Graph 3 shows the same Loan Amount of $300,000.00 but with only 9% yearly interest. Note that our columns are now shorter, meaning your interest payments are lower over time. The monthly interest payment is only $1,500.00, which translates to total interest payments of only $18,000.00 for the whole loan term.

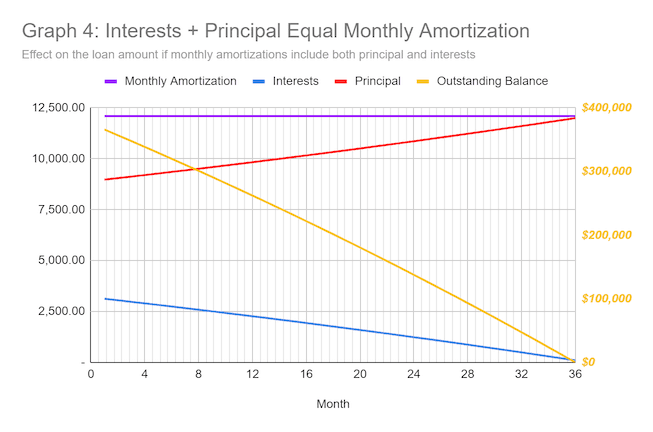

Interests + Principal Equal Monthly Amortization

Another financing scenario common to mortgages is including principal payments in the loan amortization. Monthly amortization includes both principal and interest payments. The following graph illustrates this concept.

Graph 4 assumes a loan amount of $375,000.00, the loan interest rate is 10% per year, and the loan term is now 36 months instead of 12 months. In this case, your monthly amortizations are equal. The yellow line representing the principal loan amount tapers from $375,000 to $0 as the loan matures in 36 months. The violet line represents equal monthly installments of $12,100.20. Notice that the red line, representing principal payments, trends upwards from your first payment until maturity. The blue line, representing interest payments, goes down to only $100.00 on the last installment. Note that in any month, payments made on the principal and interest will always equal your monthly amortization.

Our Take

Decoding hard money loan terms equips real estate investors with additional knowledge in planning and implementing their real estate projects. Understanding these concepts will allow you to visualize different funding scenarios and choose the best for your project. Hard Money Loans are perfect because they release funds quickly and are only short-term despite the relatively high-interest rates. What matters most is that you get the funds fast for your project so you can implement and finish it quickly.

For more on Hard Money Loan terms and how you can make them work for you, call us now at 832-770-9415 or fill out our contact form.