Investor’s Dilemma: Buy and Hold or Fix and Flip in Houston?

Houston, Texas, often referred to as the “Space City,” is known for its diverse economy, robust job market, and vibrant culture. As a result, it has become an attractive destination

Houston, Texas, often referred to as the “Space City,” is known for its diverse economy, robust job market, and vibrant culture. As a result, it has become an attractive destination

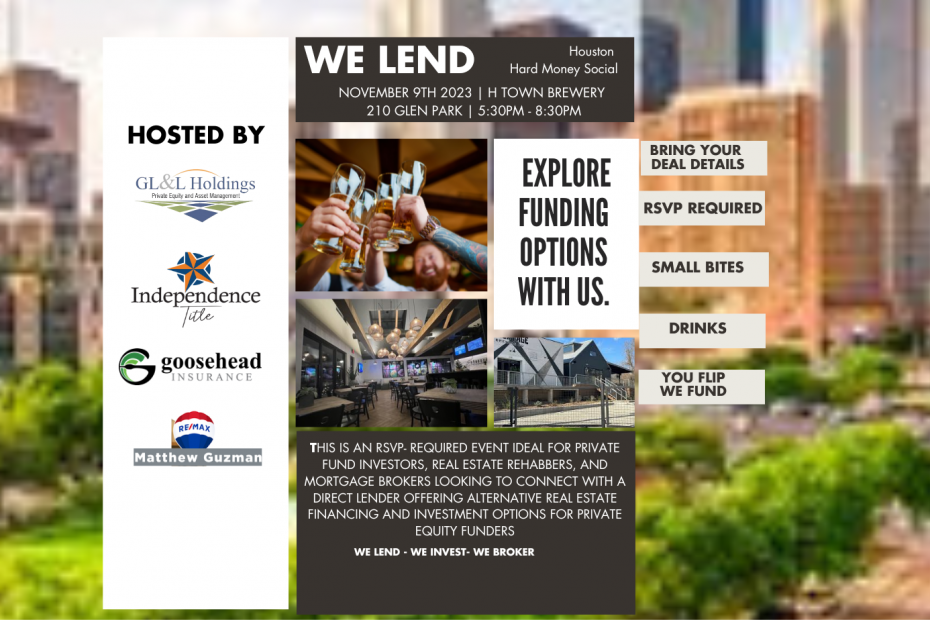

Save the Date! Join us on November 9th, 2023 at the bustling H Town Brewery located at 210 Glen Park for an evening of networking, light bites, refreshing drinks, and

House flipping, the art of purchasing a distressed property, renovating it, and selling it for a profit, has become an increasingly popular venture in recent years. While the promise of

Property investors typically go to Hard Money Lenders for funding with their real estate deals. Hard Money Loans as the preferred funding option highlight fast access to funds and a

Why Interest Rates Matter Less Than You Think. A Lot Less. “Rates are important and should definitely be a consideration when choosing your lending partner. However, they are not the

Empowering House Flippers through Hard Money Loans The current state of the commercial real estate market echoes the challenges faced by many industries in the wake of the pandemic. Plummeting

I can’t believe August is over and we’re now moving into September and the end of the year is just around the corner. With this in mind I want to

There is plenty of bad or wrong information out there—and falling for some of it can cost you money. It could be other people who steer you in the wrong

When I speak with people that are interested in real estate whether it’s to invest or to get licensed in the industry, I realize that they don’t understand the realities

Whether you are a beginner or an experienced real estate investor, writing a compelling hard money loan proposal ensures a smooth application process for a hard money loan. Your proposal