Understanding Loan To Value Ratio and Interest Rates in Hard Money Loans For Your Real Estate Investments

Financing is one way of starting Real Estate investments. Seasoned investors almost always use loans in building their portfolios. Knowing more about what you should consider in a loan application to finance your real estate venture will help package your deal better, beginner or otherwise. This article will help you learn more about the Loan To Value Ratio and Interest rates on hard money loans. These are among the considerations in analyzing your funding for your real estate deal. You will discover insights on how the Loan to Value Ratio and Interest Rates can get you a better deal in Real Estate Financing using Hard Money Loans.

What is Loan-To-Value Ratio

Loan To Value Ratio, often abbreviated to LTV, measures your loan amount against the appraised value of a real estate property you offer as collateral. Often you will find it expressed in percentage in Real Estate financing. Because the LTV represents your loan amount, the difference you get if you subtract it from the property’s appraised value is your equity. When you buy, it is also known as your down payment on the property. Loan To Value Ratio requirement varies between lenders. Some traditional banks accommodate as much as 90% LTV.

How to Calculate LTV

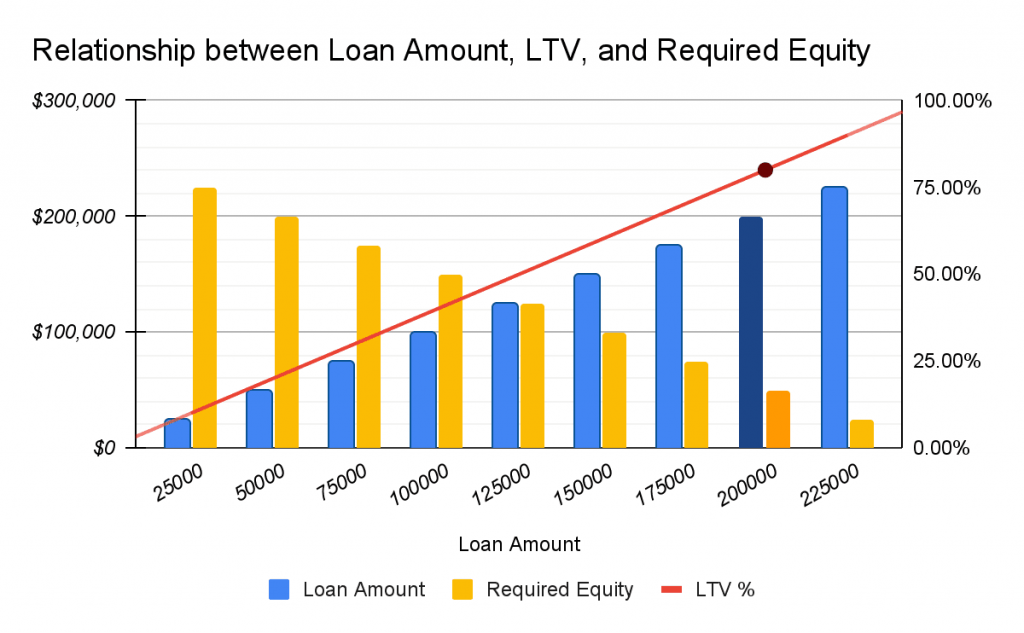

To illustrate how to calculate Loan to Value ratio, take a real estate property with an appraised value of $250,000. Now imagine you have approval for a loan against the real estate property for $200,000.00.

Your Loan To Value Ratio, in this illustration, is computed as follows:

LTV = ( 200,000 / 250,000 ) X 100, that is, your loan amount of $200,000 divided by the property value of $250,000, and the result is multiplied by 100 to get the percentage. The equation will give you 80% as the resulting value for your LTV Ratio. The amount not covered by the loan, $50,000 in this case, shall be the equity portion of the property or your Down Payment. The higher your LTV, the lower your down payment or equity.

In hard money lending, lenders compute the LTV from the After Repair Value of the property or ARV. The After Repair Value is the property’s projected value based on your rehab plans.

The graph shows that your Loan Amount increases when LTV rises. Conversely, your Required Equity goes down. The darker columns and the dot on the LTV% illustrate the example in the paragraph above.

The Importance of LTV in Hard Money Lending

Hard Money Lenders evaluate your loan application mainly on the collateral you present. They are asset-based lenders and take more risks than traditional lenders. Your financial capacity and credit history are secondary in evaluating your application. Thus, usually, they only approve loans with a 70% LTV. Although not always the case, the Loan to Value Ratio reflects a borrower’s financial capacity. A borrower who can afford higher equity or down payment will most likely maintain regular repayments.

Hard Money Loan Interest Rates

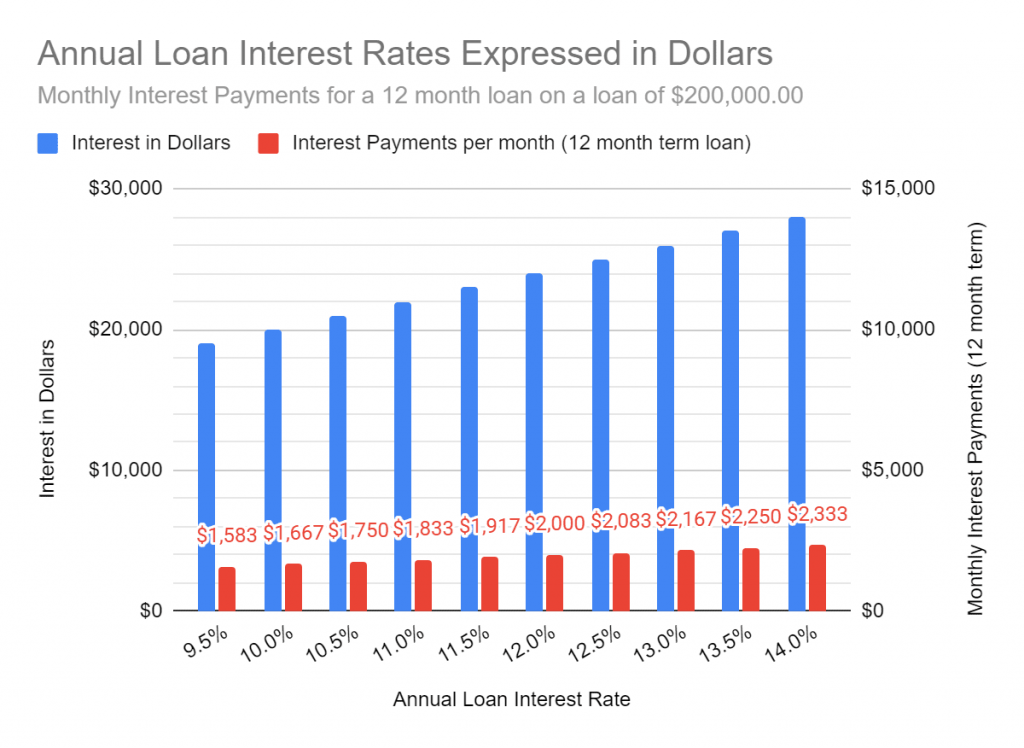

Interest Rates on Hard Money Loans is the charge you pay for using borrowed money. It is the fee you pay the lenders for using their money to buy and rebuild the real estate property you want to invest in. Interest rates on Hard Money Loans differ between lenders and even between real estate deals. Hard Money Interest Rates can range from 9.9% to 15% per year. The riskier your real estate deal is, the higher your loan interest rate.

The Importance of Rates on Hard Money Loans

Interest Rates on Hard Money Loans impact your monthly budget directly. A loan with a higher interest rate will mean more monthly payments for you. Consider the following scenario: A loan of $200,000 with an annual interest rate of 10% will make you pay $20,000 in interest alone in one year. So if your rate goes up two percentage points, that means an additional $4,000 on the interest payment alone.

The figures above the red columns are the monthly interest payments one has to pay based on the loan interest rate for a 12-month term and a loan amount of $200,000.00.

How LTV Can Affect Loan Interest Rate

Understanding Loan To Value Ratio and Interest Rates on Hard Money Loans gives you room to play in working out the best financing deal with your lender. However, there are other factors to consider when you apply for a Hard Money Loan.

Real Estate Investors favor Hard Money lenders when they need funding for their deals. After all, hard money lenders accept rundown properties for collateral. They are more concerned about the After Repair Value of the property. The ARV, as it is also known, is the projected valuation of your property. It is the property value after rehab, based on your proposed repairs. Thus, Hard Money Lenders need to know your plan for the property, including the rehabilitation plans and overall cost. Second, your experience in real estate investing: like how many deals you have under your belt. Beginners in the industry, though, are also welcome. Third is your exit strategy, which defines how you will pay off your hard money loan, noting that they are only short-term. For instance, house flippers pay off their hard money loans with the funds they will get from their buyers. For rental property investors, they transfer the mortgage to lenders that offer long-term loans.

Why You Want a Hard Money Loan

Despite the seemingly low Loan To Value and relatively high-interest rates on hard money loans, they are still the preferred funding alternatives for real estate investors. The benefits of a fast release of funds, fewer documentary requirements, and acceptance of rundown real estate properties far outweigh the benefits of loans offered by traditional banks. Because you can get your funds quickly, you can immediately start repairs on the real estate property and implement your exit strategy. Thus, you can recover your investment faster with profit to spare. Or, for rental property investors, you can put your rehabbed property earlier on the rental market and then transfer the mortgage to traditional banks.

Let’s Get You Started

You now have a better understanding and a good foundation about Interest Rates on hard Money Loans and Loan To Value ratios. With these new outlooks, you can now begin your real estate investment journey on a more knowledgeable footing. Call us now at (832)770-9415 to know how you can start. You can also send an email to info@gllholdings.com. Our bilingual officers and staff will be glad to help you along.